One of the frustrating parts of being a lawyer (there are many) is that, sometimes, you can’t get your case set for hearing as fast as you (or your client) would like it to be. The legal system moves at its own pace, and it’s generally not built for speed.

This is especially true in mid-March (spring break) and mid-October (fall break/judicial conference), when court dockets might be unavailable or closed.

Time is money for my clients, and they tend to want to get in front of the judge as soon as possible. One or two weeks of closed dockets can add 30-60 days of delay.

Under Tennessee law, if a defendant in a lawsuit fails to respond or otherwise defend “as provided by these rules,” the plaintiff can get a judgment by default. See Tenn. R. Civ. P. 55.01. This generally means that, after service of a lawsuit, a defendant must file an answer within 30 days. If they don’t, you file a motion saying that and, generally, you win.

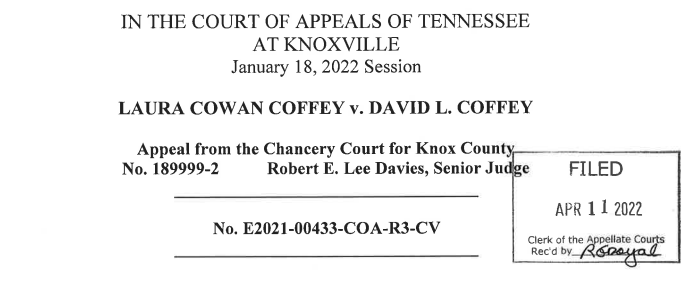

For years, I had this theoretical question: If a plaintiff filed a motion for default prospectively–before the answer deadline had expired–and, if the defendant failed to answer by the 30 day deadline, would a judgment by default be entered?

This spring, I got my answer.

I had a case where defendant’s answer date was approaching, but the court’s motion calendar showed dockets in late March…and then mid-May. Yikes!

The deadline for my defendants to answer was March 15. March 14 was the deadline to get my Motion for Default heard on that last, March 28 docket. Should I file a day early (and see if they file an answer) or should I wait?

I got my clarity: My Motion was denied, with the text of the order noting that my motion was filed “twenty-nine days after Defendants were served.” As a result, the Motion “was untimely since less than thirty days elapsed between the date of service and the date Plaintiff filed its motion.”

In the end, then, it didn’t matter that the defendants never filed an answer, including between the filing date (March 14) and the scheduled hearing date (March 28). The original motion was premised on a condition that had not yet occurred.

As a result, upon receipt of the order, I filed a new Motion on March 28, set it for May 15, and got my default judgment then.