I’ve called Tennessee’s non-judicial foreclosure process “a little scary.” It follows a byzantine process, is all paperwork, there’s no judge involved, and a single misstep can lead to your foreclosure being challenged.

Tennessee offers a unique pitfall for the unwary: It’s a “two track” state, meaning that a foreclosing lender must satisfy the requirements of both the Tennessee foreclosure statutes and the requirements agreed to by the parties in the Deed of Trust.

And those two tracks don’t always align.

On that note, let me tell you about the sale of a multi-million dollar property I watched on October 31 .

The Notice of Foreclosure Sale was first published in the Nashville Ledger on October 11, 2024 , and the sale was set for October 31, 2024 at 10AM at the Davidson County Courthouse.

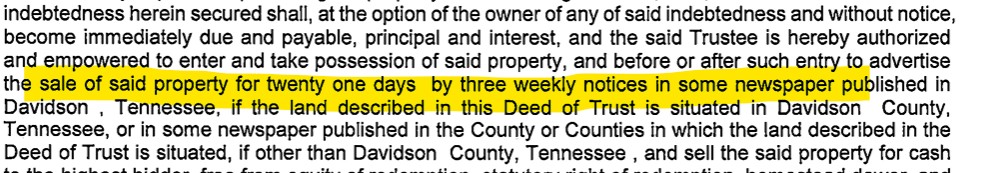

That’s a tight timeline, since Tenn. Code Ann. § 35-5-101(b) requires that “The first publication shall be at least twenty (20) days previous to the sale.” In fact, by my own math, the 10/31 sale date fell on the twentieth day after publication, and I wondered whether, legally, this sale satisfied this statute (maybe, maybe not).

It didn’t matter, because I then read the Deed of Trust.

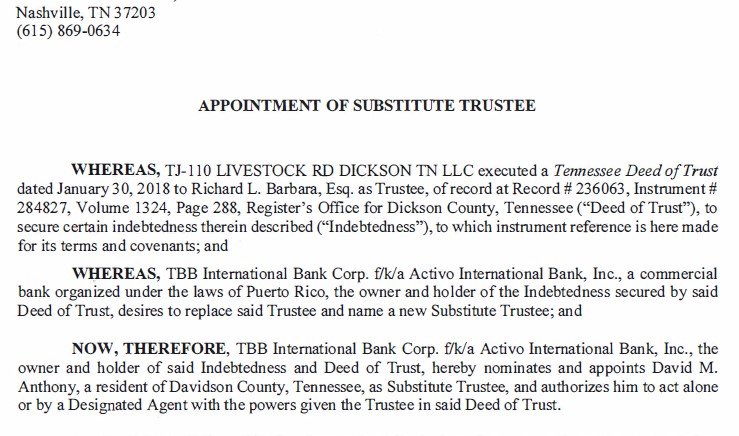

The Deed of Trust adds an extra day to § 35-5-101(b) minimum and requires that the first publication precede the sale by 21 days. This sale clearly didn’t satisfy that requirement.

About 6 bidders attended the sale, but none of them bid. The bank bought the commercial property for nearly $4 Million, and, in the Trustee’s Deed, recited the following:

Did the foreclosing lender double-check the Deed of Trust text? Is this a valid sale? Did good title convey from this sale? Did the failure to follow the terms of the Deed of Trust chill the bidders’ interest? Would this qualify as an “irregular” sale that would prevent collection on any unpaid debt pursuant to Tenn. Code Ann. § 35-5-117? Lots of interesting issues flowing from this sale.

I don’t like “interesting issues” on my foreclosures. When I prepare a sale notice, I check and double-check everything. When I’ve got a bunch of foreclosures set, you’ll find pen dots all over my calendar, from all the day-counting.

Foreclosures are complicated, and the failure to get it right can result in a challenge from all different directions. A borrower who doesn’t want to lose the property. A buyer who may not receive clear title. A lender who expects you to follow the process. A bankruptcy trustee who wants to blow it all up.

It’s a tricky process, and there’s too much risk when making an error. None of the goblins who visited my house later that night scared me more than what I saw happen at that foreclosure.