For nearly a decade, I’ve been writing about the Tennessee post-judgment interest statute, Tenn. Code Ann. § 47-14-121, which was amended in 2012 to change from the long-standing fixed rate of 10% to a variable rate that changes every 6 months.

I say “writing,” but others may say “complaining.” They’d probably cite this post: What I Don’t Like About the New Post-Judgment Interest Rate Statute In Tennessee (Everything).

My initial concern was one that many Tennessee lawyers shared: Because the interest rate is subject to change every six months, will the applicable rate on an existing judgment also change every six months?

Nobody knew. Not attorneys. Not court clerks. Not even the trial court judges.

In a very helpful comment to this 2020 post about the issue, Tennessee attorney Michelle Reynolds provided the best answer I’d seen (and one that I’ve since argued):

From the TNCourts.gov website: “Beginning July 1, 2012, any judgment entered will have the interest set at two percent below the formula rate published by the Tennessee Department of Financial Institutions as set in Public Chapter 1043. The rate does not fluctuate and remains in effect when judgment is entered.”

Of course, that’s not a case or a statute. It’s an “introductory paragraph on the Administrative Office of the Courts website.”

In an opinion issued last night, however, we have our answer!

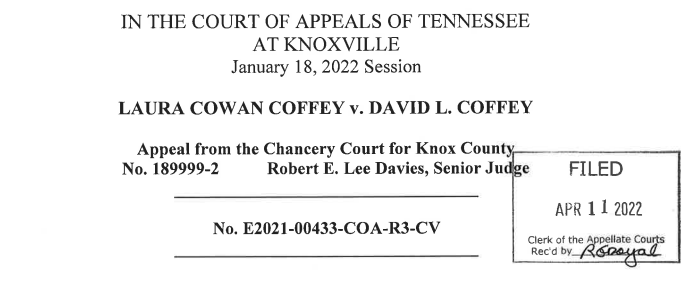

In the case (Laura Coffey v. David L. Coffey, No. E2021-00433-COA-R3-CV (Tenn. Ct. App. Apr. 11, 2022), the Tennessee Court of Appeals notes this long-standing confusion and then immediately dispels it.

In its analysis, the Court notes that the rate to be applied under Tenn. Code Ann. § 47-14-121(a) is clear and unambiguous (it’s math), and it’s the entirely separate provision at Tenn. Code Ann. § 47-14-121(b) that introduces fluctuations in the general rate. Noting the clarity in (a), the Court finds that (b) does not create ambiguity as to existing judgments.

Under Tenn. Code Ann. § 47-14-121(a), the Court writes, the “applicable post-judgment interest rate does not fluctuate when applied to a particular judgment; instead, it remains the same for the entire period of time following entry of the judgment…until the judgment is paid.”

It’s always a great day when an unresolved issue gets clarity. Sometimes I make a joke that only “law nerds” will appreciate a legal development like this; for this one, though, I think all Tennessee lawyers will benefit from this opinion.