The practice of law is “form” driven. That means that, once a lawyer drafts a really good document, she tends to go back to that document the next time that same issue comes up.

This is particularly true with foreclosures in Tennessee.

Tennessee statutes strictly define what must be included in a foreclosure advertisement at Tenn. Code Ann. § 35-5-104. As a result, a smart foreclosure attorney might start with an old form foreclosure notice, but then compare that against the statute’s checklist, and use that revised document as a form for all of his future foreclosures. (A dumb attorney would just run with whatever is in the form–or what AI says–and not doublecheck it against the law.)

With a little bit of detail work on the front end, a savvy lawyer has a form document that will guide him for years…until the law changes.

This week, I and the Tennessee Bankers Association taught a class for the Knoxville Bar Association called “Modernization of Tennessee’s Foreclosure Laws“, which tracked the foreclosure law changes that went into effect on July 1, 2025.

The TL;DR version is that the newspaper publications have been reduced from 3 times to 2 times and, now, foreclosing parties must post the notice with a “third-party internet posting company.” See Tenn. Code Ann. § 35-5-101.

If you are updating your form, however, you need to dig in on that other statute. There’s a discrete change in the sale notice requirements.

It’s at Tenn. Code Ann. § 35-5-104(a)(7), which adds that the sale notice “shall…[i]dentify the website of the third-party internet posting company that posts an advertisement pursuant to § 35-5-101(a)(2).”

I’m posting this warning because, candidly, I didn’t catch this change in my first reading of the new statutes. Instead, when I was preparing my first “post-July 1” sale notice, I went online and read other recent advertisements, to see what changes other law firms had made on their forms.

In doing that, I noticed this text in many of them: As of July 1, 2025, notices pursuant to Tennessee Code Annotated § 35-5-101 et seq. are posted online at https://foreclosuretennessee.com by a third-party internet posting company.

That’s weird, I thought. Why are they saying that? That’s when I dug in on § 35-4-104 and found that little change.

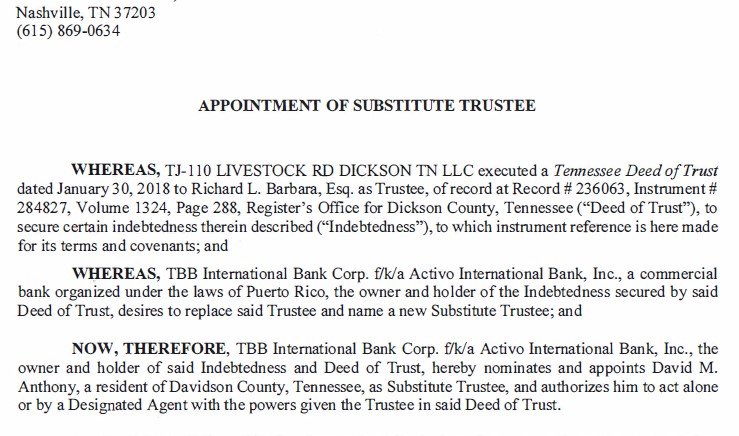

Non-judicial foreclosures in Tennessee are tricky. You have to comply with both the letter of the statute exactly and with the terms of the relevant lien instrument. In short, you have to be awesome at paperwork.

Big-picture compliance with the changes in Tenn. Code Ann. § 35-5-101 is easy. This post is a reminder that there’s a very little change in Tenn. Code Ann. § 35-104 that could have a big impact on your sale.