This past weekend, I got an e-mail from a title company. A buyer at a January foreclosure was refinancing the property he had just purchased, and the title company requested copies of my foreclosure documents to make sure my sale complied with Tennessee foreclosure laws and that the cash buyer at my sale holds clear title.

Under the law, I had no obligation to respond. Tennessee foreclosures are often described as “buyer beware.” This means that bidders are expected to conduct their due diligence before the sale, including a title search and the statutory foreclosure requirements were followed.

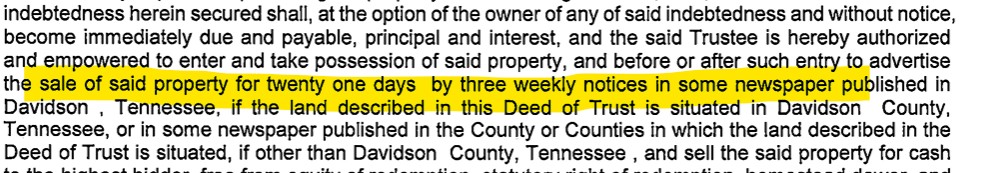

What many “get rich at foreclosures” news stories fail to mention is that Tennessee’s non-judicial foreclosure sale process is complex, technical, and filled with potential pitfalls-both for the sellers and the buyers.

Some foreclosure attorneys take the position that once the sale is concluded and the funds are received, their role is finished. From that perspective, there may be little incentive to respond to a title attorney’s persnickety follow-up questions or to revisit the details of a completed sale. It’s a complex process, with lots of hoops to jump through, and why allow someone to poke around under the hood?

I take a different approach.

I always respond to these requests. I maintain a busy foreclosure practice, and my goal is to build — and protect — a reputation for conducting foreclosure sales that strictly comply with Tennessee law and convey clear, marketable title. When bidders know that my sales are handled properly, they are more confident in participating. More confidence leads to more bidders — and more competitive sales for my lender clients.

In foreclosure work, reputation matters. Clear title matters. And attention to detail matters long after the cash lands on the barrell (that’s “foreclosure talk” for the money gets paid).

Frankly, the real “buyer beware” is for the sales done by attorneys who refuse to respond and provide details.