I promised a follow-up to my “Best of List,” but, since complaining is more fun, I am writing about some things I disliked in 2022.

The courts system’s quick return to pre-COVID practices. You remember my rant when I caught COVID on a 5 hour docket in July. I think courts were too quick to abandon the pandemic innovations and return “to the way law was practiced when people rode horses to court.” Sure, a court might let you call-in for a hearing, but there is always a risk the technology won’t be up to speed, the judge won’t realize you’re on the line, or she won’t be able to hear you on the invariably staticky line. Having seen the trouble other lawyers had with call-in appearances, I decided to never risk my client’s case on a remote appearance. When in doubt and given the option, lawyers will generally appear in person. How about–for some hearings–there’s a process that allows for no other option other than to call-in?

There’s no state-wide, uniform e-filing system. My law practice has a fairly small foot-print. (My marketing materials call it a “curated practice.”) In the 3-4 counties where I do most of my work, I have separate log-ins for the different courts in each of those counties. Each e-filing system has its own set of rules, exclusions, and peculiarities. E-filing is awesome, so I’ll take a bad system over no system. But, having said that, why can’t the State of Tennessee establish a uniform system?

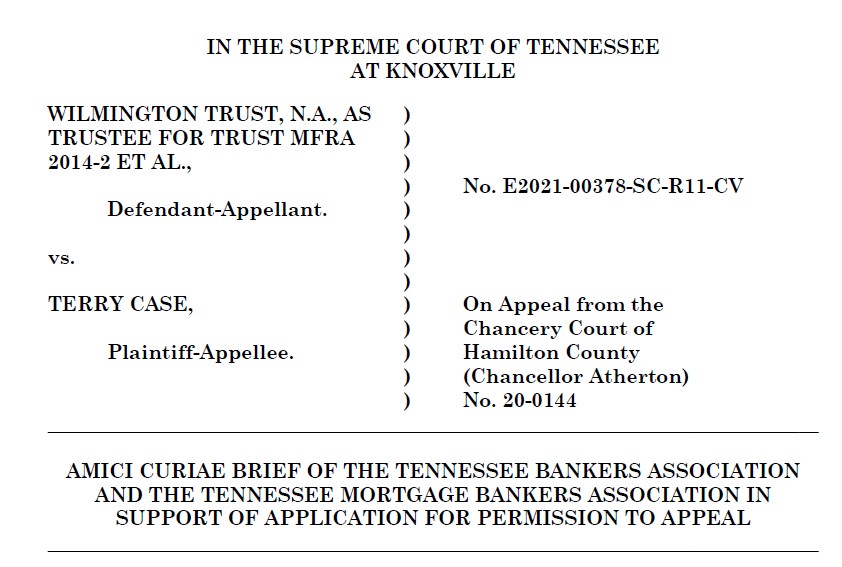

Our Tennessee foreclosure system is entirely based on physical newspapers. Until recently, I had a newspaper subscription, even though: (a) for the past 20 years, I’ve gotten 99% of my news online; (b) my local newspaper had shrunk to about 10 pages (total); and (c) my newspaper carrier generally delivered my morning paper either 8 hours late, the next day, or not at all. Physical newspapers are possibly the worst way to convey information in our modern age, but, nevertheless, Tennessee’s entire foreclosure and UCC sale system is tied directly to published notices in physical copies of newspapers. All over the country, newspapers are going to an online-only model (followed, most likely, by going out of business). But our foreclosure laws haven’t been updated. We’re headed for trouble unless we change these laws.

There’s no penalty for bogus lien filings in Tennessee. Sure, there’s the toothless “exaggeration of lien” statute (Tenn. Code Ann. § 66-11-139) or the confusing “slander of title” cause of action, but, by and large, if somebody records a piece of paper with “Notice of Lien” written somewhere on it (and includes the owner name and property address), they’ve got a totally un-lawful, but also practically-effective, lien. A few years ago, the Tennessee Legislature passed Tenn. Code Ann. § 66-21-108, which gave property owners a nuclear bomb to deal with invalid lien claims, but it was repealed within a year. As it stands now, there’s no useful remedy, other than to pay the invalid lien or to cancel your transaction.

Big Mortgage Lenders refuse to provide payoffs on their debts with impunity. One of the weirdest sub-plots throughout my 2022 was how near-impossible it was to get a payoff from mortgage lenders. In December, I had to sue a mortgage lender to get a payoff (and to stop an immediately pending foreclosure sale). It might have been the dumbest lawsuit I’ve ever filed (dumb as in the other side was dumb to make me go to the trouble): Within 24 hours of my getting a foreclosure injunction, the lender provided the payoff and, within a few hours of that, it was paid off in full. A win, except it cost more than $5,000 in unrecouped legal fees to address an unnecessary situation. There needs to be a law that imposes penalties, including attorney fees, in these situations.

I spent the entire year in a sales funnel. In 2022, after a full year as a small business owner, I took some time to evaluate my existing legal technology and services and what needed to be upgraded. On legal tech websites, I’d enter my email in order to download some awesome “Free Guide To _____” that promised a magical solution or explanation for some common problem or process. Having downloaded a number of those (none of which solved any problem), my phone rang all year long, over and over, with sales calls. It’s not “free,” if I end up in a Sales Funnel. My advice to service providers: How about sharing your expertise, impressing me with your vast knowledge, and leaving me alone, confident that I’ll return to you for my buying needs?

Phone calls from Tom James Company custom clothiers were the worst. If I ever find out who sold my name and phone number to Tom James Company, I will immediately sever ties with that organization (I suspect one of the bar associations did it). Tom James representatives were relentless in 2022. They called me so many times that I remembered the caller’s name (from the prior week’s call), could recite their opening line back to them, and remind them that I was the person who wasn’t interested because I buy all my suits from South Korea, just like BTS (not true, but why not go big, right?). After maybe 25 calls in 2022, I reached out to Tom James corporate, and asked if I could pay them something to be added to a no-call list.

Dealing with global, multi-state law firms. All of Nashville’s medium to big law firms are slowly selling out to mega-law firms. For the most part, I still deal with local folks on my litigation matters, but, on matters where a Tennessee law license may not be required, I have to deal with out-of-towners, and it’s rarely a pleasant, easy relationship. It’s a trend I’m dreading, as these firms bring their billable rates, minimum hourly requirements, other customs into the work they do in the local market. In short, their weirdness makes my job harder.

I miss old twitter. Many years ago, while waiting at a docket call in Montgomery County, I tweeted that I forgot to bring a pen for court. Within a minute, a local lawyer who follows me on twitter introduced himself and handed me a pen. Over the past decade plus of very-regular twitter use, I have found a vibrant and diverse lawyer community who post updates, victories, and advice. It’s awesome. Over the last few months, it’s gotten less active. If twitter as we once knew it goes away, we will have truly lost something.

The Lawyer-Industrial-Complex has gotten out of hand. Have you tried to hire a lawyer lately? If so, you were probably shocked by their hourly rates. The Clio 2022 Legal Trend Report (warning, you have to enter your email to access it) says that, in fact, lawyer rates are too low and haven’t risen with the general rate of inflation. I don’t know about that, but, holy smokes, lawyers and all the law adjacent services are so expensive right now. I’m using a Westlaw Rules of Civil Procedure book from 2020 because a new set (that will be obsolete in a month) is nearly $1,000. Some lawyers say that this isn’t a problem (more money in my own pocket, right?), but, frankly, it’s a trend that I don’t like. Prices are going up, but the quality of service is staying the same.

Having said that, where are all the good, reasonably priced Nashville lawyers? As noted above, I keep a small footprint for my law practice, and I refer out about 2/3 of the “new client” calls I get. My biggest problem with referrals has been “To whom”? I only refer cases to lawyers who will make me look good and will do an awesome job. Everybody on my existing list is swamped right now. What Nashville lawyer does good, competent, cost-efficient work? And, also, is looking for more work? I can’t find him or her. But I’m looking.